|

| Photo Credit |

Summer is usually brimming with activities, and it doesn't have to be a drag just because I'm on a budget. I did, however, have a bit off an off-month in July.

This month, I drove a lot. I was in my car considerably more than usual, driving to freelance gigs and to my hometown and to a distant campground. As a result, I spent 65% more on gas.

I came in under on my grocery bill again. People gape when I tell them I spend $490 each summer on a 20-week CSA share, but the massive amount of produce I get for $24.50 each week is more than enough to feed both me and the beau with minimal additional shopping. Pantry staples like grains are cheap, and buying fruits in season keeps costs down. I don't eat meat-heavy meals, so one steak is enough for the two of us. Groceries used to be one of my biggest hurdles, but I've found that eating lots of produce (fresh when in-season, and frozen in the winter) minimizes both my expenses and my waistline.

I also came in way under budget on my energy bill. Not using my clothes dryer has been one of the best tools for cutting costs! My entire home's energy bill came in under $57 for the second month in a row. I also barely used my air conditioner because this summer has been so cool.

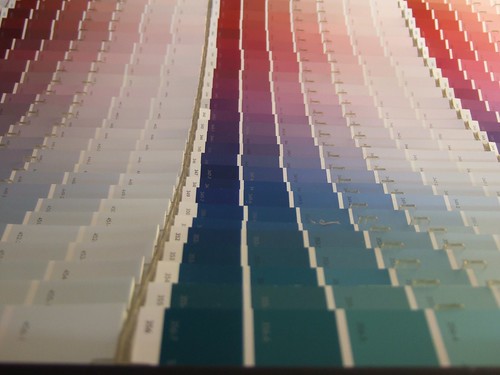

Everything else came in at the budgeted amount... And then, I bought paint. I bought lots and lots of paint.

|

| Photo Credit |

Also, I ate at restaurants far more than usual this month. When work got so hectic that I was lucky to get ten minutes between meetings, I'd have to settle for food on-the-go. Sometimes, when I wasn't too tired to function, I'd prepare something ahead of time and take it with me. I tried to keep costs down by settling for a bagel with cream cheese or a cup of soup with crackers, but dining expenses still add up. I know I could have done better here.

The cost of dining out plus the paint supplies (even on sale) brought me $320 over my July budget.

Normally, this would be a massive "ouch" moment for me. However, I had an especially good month on eBay, and I also received my benchmark check from work. All of these things were a tremendous blessing: I eliminated extra items from my home, the items went to someone who will use them instead of being discarded, and the bonus check was higher than I expected. I decided that, because of the huge paint sale, I would use some of that extra income to tackle that home improvement task now instead of later.

The rest of the money went straight into my savings. I'm still trying to recover the amount I spent on re-financing my home post-divorce. Since February, I've managed to replenish 60% of my emergency fund. Because of my strict budgeting, my eBay sales, my freelance jobs, my tax return, and my benchmark check, what I initially thought would take me three years to recover is nearly two-thirds complete in just six months.

I've learned that spending reflects what we value. If you go out for cocktails, have spa treatments, go to music concerts, buy clothing and accessories, or purchase restaurant meals too often... then you can't complain about finances when it's time to pay rent or fix your car! Some people out there legitimately struggle to pay their bills and feed their families and keep a roof over their heads. Irresponsible spending is not the same thing.

Each time I said no to a drink with the ladies, or turned down a night of dancing to a live swing band, or stayed home to cook dinner with the beau instead of going out to a restaurant, I used to think I was making a sacrifice. But you know what? I still hang out with my friends; I just don't buy booze. Yes, this can sometimes draw inappropriate questions, such as "Are you pregnant?" (Seriously, cut that out.), but I am saving several dollars for every cocktail I don't drink, and I'm also not drinking all of those calories!

I've found plenty of cheap and free things to do in this city over the past month: camping in a borrowed tent with friends (we walked on trails, swam in a lake, and played hilarious card games); relaxing at the beach with a picnic lunch and a good book; taking walks in the park; going to the budget cinema; attending free music festivals (Chill on the Hill and Jazz in the Park); watching Netflix with the beau (we like New Girl); using online coupon sites for discounts on activities (like the drive-in movie double feature we saw last week)!

Now, when I see how much closer I am to having what I truly want, I realize that giving up those things wasn't a sacrifice at all. Life is always about choices. What do you really value?

No comments:

Post a Comment